Net Assets

Consolidated balance sheet structure

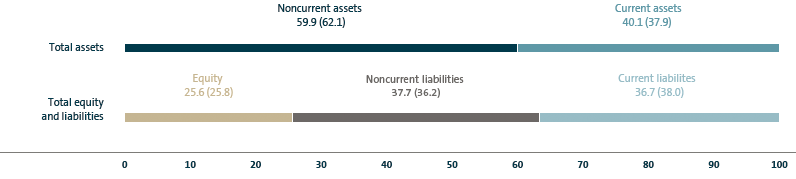

The Volkswagen Group’s total assets amounted to €458.2 billion at the end of fiscal year 2018, 8.5% more than at the end of the previous year; the main contributing factor was the increased business volume in the Financial Services Division. The structure of the consolidated balance sheet as of the reporting date is shown in the chart on this page. The Volkswagen Group’s equity was €117.3 (109.1) billion on December 31, 2018. The equity ratio was virtually unchanged from the previous year, at 25.6 (25.8)%.

The implementation of the new International Financial Reporting Standards led to adjustments to the opening balance sheet of the Volkswagen Group as of January 1, 2018. The amounts as of December 31, 2017 were unchanged, apart from movements within equity.

As of the end of fiscal year 2018, the Group had off-balance-sheet commitments in the form of contingent liabilities in the amount of €9.3 (8.4) billion, financial guarantees in the amount of €0.3 (0.3) billion and other financial obligations in the amount of €26.6 (23.5) billion. Contingent liabilities relate primarily to legal risks in connection with the diesel issue as well as potential liabilities from tax risks in the Commercial Vehicles Business Area in Brazil. The other financial obligations primarily result from purchase commitments for property, plant and equipment, obligations under long-term leasing and rental contracts and irrevocable credit commitments to customers. In addition, they include investments to which the Group has committed itself in the infrastructure for zero-emission vehicles and in initiatives to promote access to and awareness of this technology. These commitments were made as part of the settlement agreements in the USA in connection with the diesel issue. Other financial obligations include an amount of €1.3 billion for this purpose.

CONSOLIDATED BALANCE SHEET STRUCTURE 2018

in percent

Automotive Division balance sheet structure

As of December 31, 2018, the Automotive Division’s intangible assets and property, plant and equipment were both up year-on-year. Equity-accounted investments rose slightly. The dividend distributions resolved by the Chinese joint ventures were set against positive business results of the Chinese joint ventures and the acquisition of the shares in Quantum Scape. The decrease in noncurrent other receivables and financial assets was due among other factors to the negative impact from the measurement of derivatives. Overall, there was a slight increase in noncurrent assets, to €143.2 (140.9) billion, compared with the previous balance sheet date.

At €91.4 (80.2) billion, current assets were up significantly compared with the end of 2017; the inventories included in this figure increased by 14.4%, mainly for production-related reasons and because of the changeover to the WLTP test procedure. The decrease in current other receivables and financial assets was due mainly to the negative impact from the measurement of derivatives. Cash and cash equivalents were significantly higher than on December 31, 2017, rising to €24.2 (13.8) billion.

Equity in the Automotive Division amounted to €88.9 billion at the end of 2018. This 8.9% incease on the previous year’s balance sheet date was mainly a result of the healthy earnings growth and the hybrid notes issued in June 2018. The negative effects from the measurement of derivatives recognized outside profit or loss and currency translation, the dividends paid to the shareholders of Volkswagen AG, the redemption of the hybrid notes terminated in the third quarter of 2018 and the non-recurring impact of the first-time application of the new International Financial Reporting Standards reduced equity in the Automotive Division. The noncontrolling interests are mainly attributable to RENK AG and AUDI AG. As these were lower overall than the noncontrolling interests attributable to the Financial Services Division, the figure for the Automotive Division, where the deduction was recognized, was negative. The equity ratio was 37.9 (36.9)%, up on the figure as of December 31, 2017.

Noncurrent liabilities went up to €77.7 (69.8) billion, driven mainly by the rise in the noncurrent financial liabilities included in this item.

Current liabilities declined to €68.0 billion, in total 2.5% down on the end of 2017. The item “Put options and compensation rights granted to noncontrolling interest shareholders” primarily comprises the liability for the obligation to acquire the shares held by the remaining free float shareholders of MAN; following the ruling in the award proceedings, the extraordinary notice of termination of the control and profit and loss transfer agreement, and the cash outflows for the cash compensation and the acquisition of shares tendered, this item was adjusted accordingly to €1.9 (3.8) billion. Reclassifications from noncurrent to current liabilities due to shorter remaining maturities were among the factors that led to a rise in current financial liabilities compared with the end of 2017. The figures for the Automotive Division also contain the elimination of intragroup transactions between the Automotive and Financial Services divisions. As the current financial liabilities for the primary Automotive Division were lower than the loans granted to the Financial Services Division, a negative amount was disclosed in both periods. Current other provisions included in current other liabilities declined due to their use in connection with the diesel issue.

On December 31, 2018, total assets in the Automotive Division amounted to €234.5 billion, 6.1% more than at the end of 2017.

| (XLS:)

|

PASSENGER CARS BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

Dec. 31, 2018 |

Dec. 31, 2017 |

||

|

|

|

||

Noncurrent assets |

112,796 |

111,277 |

||

Current assets |

65,882 |

60,052 |

||

Total assets |

178,678 |

171,329 |

||

Equity |

70,817 |

66,449 |

||

Noncurrent liabilities |

62,445 |

55,118 |

||

Current liabilities |

45,415 |

49,762 |

||

Intangible assets and property plant and equipment in the Passenger Cars Business Area were higher than in the previous year. The decrease in noncurrent other receivables and financial assets was due to factors such as the negative impact from the measurement of derivatives. Overall, noncurrent assets grew by €1.5 billion to €112.8 billion. Current assets increased by a total of €5.8 billion to €65.9 billion; the inventories included in this figure grew for production-related reasons and because of the changeover to the WLTP test procedure. There was a threefold year-on-year increase in cash and cash equivalents to €18.1 (6.1) billion. Total assets stood at €178.7 (171.3) billion at the end of 2018.

At €70.8 billion, the Passenger Cars Business Area’s equity exceeded the prior-year figure by 6.6%, due mainly to earnings-related factors and the hybrid notes issued in the reporting period.

Noncurrent liabilities were 13.3% higher than at the end of 2017; the financial liabilities included in this item were up significantly. Current liabilities decreased by a total of 8.7%. Current other liabilities and current other provisions were down on the prior-year figure.

| (XLS:)

|

COMMERCIAL VEHICLES BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

Dec. 31, 2018 |

Dec. 31, 2017 |

||

|

|

|

||

Noncurrent assets |

27,858 |

27,005 |

||

Current assets |

21,892 |

16,908 |

||

Total assets |

49,750 |

43,913 |

||

Equity |

15,081 |

12,194 |

||

Noncurrent liabilities |

14,493 |

13,975 |

||

Current liabilities |

20,176 |

17,744 |

||

On December 31, 2018, the Commercial Vehicles Business Area’s intangible assets and property, plant and equipment were higher than at the end of 2017. Equity-accounted investments were up, while other equity investments decreased as a result of an intragroup sale (power engineering business). Overall, noncurrent assets grew by €0.9 billion to €27.9 billion. Current assets amounted to €21.9 (16.9) billion, significantly up on the previous year’s balance sheet date. The current other receivables and financial assets included in this item increased, while cash and cash equivalents declined; the payments in connection with the intragroup sale of the power engineering business will become due in the first quarter of 2019. Total assets climbed by 13.3% to €49.7 billion.

Equity in the Commercial Vehicles Business Area stood at €15.1 billion at the end of 2018, 23.7% more than a year earlier. In addition to healthy earnings, this increase was attributable to the intragroup sale of the power engineering business. The item “Put options and compensation rights granted to noncontrolling interest shareholders” fell sharply: the item was adjusted to reflect the ruling in the award proceedings and the extraordinary termination of the control and profit and loss transfer agreement, as well as the cash outflows for the cash compensation and the acquisition of shares tendered. Noncurrent liabilities rose by 3.7%; the noncurrent financial liabilities included in this item were down on the previous year, while noncurrent other liabilities increased. Current liabilities were 13.7% higher than on December 31, 2017. Current other liabilities were significantly higher.

| (XLS:)

|

POWER ENGINEERING BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

Dec. 31, 2018 |

Dec. 31, 2017 |

||

|

|

|

||

Noncurrent assets |

2,499 |

2,629 |

||

Current assets |

3,597 |

3,250 |

||

Total assets |

6,097 |

5,879 |

||

Equity |

2,953 |

2,963 |

||

Noncurrent liabilities |

754 |

711 |

||

Current liabilities |

2,391 |

2,205 |

||

In the Power Engineering Business Area, the decline in noncurrent assets was mainly attributable to a year-on-year decrease in intangible assets. Higher inventories and receivables led to a 10.7% rise in current assets compared with the previous balance sheet date. At the end of 2018, the Power Engineering Business Area recorded a 3.7% year-on-year increase in total assets to €6.1 billion.

On December 31, 2018, equity stood at €3.0 (3.0) billion, and thus on a level with the previous year. Both noncurrent and current liabilities were up in the reporting period compared with the 2017 balance sheet date.

Financial Services Division balance sheet structure

On December 31, 2018, total assets in the Financial Services Division amounted to €223.6 billion, 11.2% more than at the end of 2017.

There was a significant rise in both lease assets and noncurrent receivables, tracking the growth in business. Noncurrent assets were up by 8.5% in total.

Current assets rose by 15.3%, driven by higher volumes. The revised classification of financial instruments required by IFRS 9 led to reclassifications, in particular of financial services receivables to trade receivables, which are included in the “Other receivables and financial assets” item. Total securities increased by €1.3 billion to €3.7 billion.

On December 31, 2018, the Financial Services Division accounted for around 48.8 (47.6)% of the Volkswagen Group’s assets.

The 3.7% rise in equity to €28.5 billion in the reporting period was mainly attributable to healthy earnings. The equity ratio was 12.7 (13.7)%.

Noncurrent liabilities were up 14.8%, mainly because of a rise in noncurrent financial liabilities to refinance the business volume. Current liabilities increased by a total of 10.3% and the current financial liabilities included in this item rose markedly.

At €29.9 (31.4) billion, deposits from the direct banking business were lower at the end of 2018 than they had been a year earlier.

| (XLS:)

|

CONSOLIDATED BALANCE SHEET BY DIVISION AS OF DECEMBER 31 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

VOLKSWAGEN GROUP |

AUTOMOTIVE1 |

FINANCIAL SERVICES |

|||||||||||

€ million |

2018 |

2017 |

2018 |

2017 |

2018 |

2017 |

||||||||

|

||||||||||||||

|

|

|

|

|

|

|

||||||||

Assets |

|

|

|

|

|

|

||||||||

Noncurrent assets |

274,620 |

262,081 |

143,153 |

140,912 |

131,467 |

121,169 |

||||||||

Intangible assets |

64,613 |

63,419 |

64,404 |

63,211 |

209 |

208 |

||||||||

Property, plant and equipment |

57,630 |

55,243 |

54,619 |

52,503 |

3,010 |

2,739 |

||||||||

Lease assets |

43,545 |

39,254 |

5,297 |

3,140 |

38,249 |

36,114 |

||||||||

Financial services receivables |

78,692 |

73,249 |

9 |

−7 |

78,684 |

73,256 |

||||||||

Investments, equity-accounted investments and other equity investments, other receivables and financial assets |

30,140 |

30,916 |

18,824 |

22,065 |

11,315 |

8,851 |

||||||||

Current assets |

183,536 |

160,112 |

91,371 |

80,210 |

92,165 |

79,902 |

||||||||

Inventories |

45,745 |

40,415 |

41,302 |

36,113 |

4,443 |

4,302 |

||||||||

Financial services receivables |

54,216 |

53,145 |

−510 |

−686 |

54,726 |

53,832 |

||||||||

Other receivables and financial assets |

37,557 |

32,040 |

13,033 |

17,354 |

24,524 |

14,686 |

||||||||

Marketable securities |

17,080 |

15,939 |

13,376 |

13,512 |

3,703 |

2,427 |

||||||||

Cash, cash equivalents and time deposits |

28,938 |

18,457 |

24,169 |

13,826 |

4,769 |

4,632 |

||||||||

Assets held for sale |

– |

115 |

– |

90 |

– |

24 |

||||||||

Total assets |

458,156 |

422,193 |

234,524 |

221,121 |

223,632 |

201,071 |

||||||||

|

|

|

|

|

|

|

||||||||

Equity and liabilities |

|

|

|

|

|

|

||||||||

Equity |

117,342 |

109,077 |

88,850 |

81,605 |

28,492 |

27,472 |

||||||||

Equity attributable to Volkswagen AG shareholders |

104,522 |

97,761 |

76,624 |

70,857 |

27,898 |

26,904 |

||||||||

Equity attributable to Volkswagen AG hybrid capital investors |

12,596 |

11,088 |

12,596 |

11,088 |

– |

– |

||||||||

Equity attributable to Volkswagen AG shareholders and hybrid capital investors |

117,117 |

108,849 |

89,219 |

81,945 |

27,898 |

26,904 |

||||||||

Noncontrolling interests |

225 |

229 |

−369 |

−339 |

594 |

568 |

||||||||

Noncurrent liabilities |

172,846 |

152,726 |

77,692 |

69,805 |

95,154 |

82,921 |

||||||||

Financial liabilities |

101,126 |

81,628 |

14,187 |

6,709 |

86,939 |

74,919 |

||||||||

Provisions for pensions |

33,097 |

32,730 |

32,535 |

32,189 |

563 |

540 |

||||||||

Other liabilities |

38,623 |

38,368 |

30,970 |

30,906 |

7,652 |

7,462 |

||||||||

Current liabilities |

167,968 |

160,389 |

67,982 |

69,711 |

99,986 |

90,678 |

||||||||

Put options and compensation rights granted to noncontrolling interest shareholders |

1,853 |

3,795 |

1,853 |

3,795 |

– |

– |

||||||||

Financial liabilities |

89,757 |

81,844 |

−1,504 |

−458 |

91,261 |

82,302 |

||||||||

Trade payables |

23,607 |

23,046 |

20,962 |

20,497 |

2,645 |

2,548 |

||||||||

Other liabilities |

52,750 |

51,705 |

46,671 |

45,877 |

6,079 |

5,828 |

||||||||

Total equity and liabilities |

458,156 |

422,193 |

234,524 |

221,121 |

223,632 |

201,071 |

||||||||