Volkswagen Group deliveries

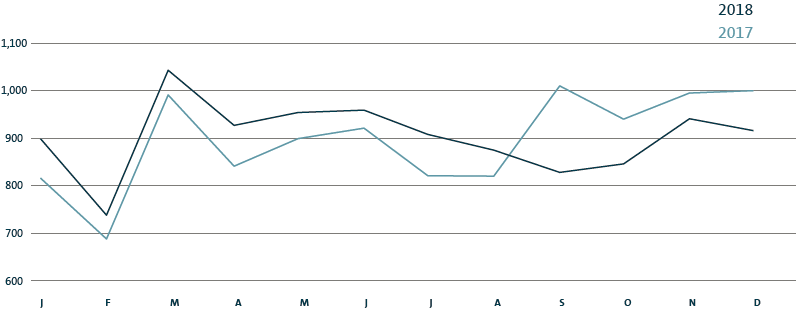

In fiscal year 2018, the Volkswagen Group increased its deliveries to customers worldwide by 0.9% year-on-year and achieved a new record of 10,834,012 vehicles. The chart on the next page shows how deliveries changed from month to month and compares each monthly figure to the same month of the previous year. Deliveries of passenger cars and commercial vehicles are reported separately in the following.

| (XLS:)

|

VOLKSWAGEN GROUP DELIVERIES1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

2018 |

2017 |

% |

|||||

|

||||||||

|

|

|

|

|||||

Passenger Cars |

10,101,297 |

10,038,756 |

+0.6 |

|||||

Commercial Vehicles |

732,715 |

702,778 |

+4.3 |

|||||

Total |

10,834,012 |

10,741,534 |

+0.9 |

|||||

VOLKSWAGEN GROUP DELIVERIES BY MONTH

Vehicles in thousands

PASSENGER CAR DELIVERIES WORLDWIDE

With its passenger car brands, the Volkswagen Group is present in all relevant automotive markets around the world. The key sales markets currently include Western Europe, China, the USA, Brazil, Russia and Mexico. The Group recorded encouraging growth in many key markets.

During the reporting period, deliveries of passenger cars to Volkswagen Group customers worldwide rose to 10,101,297 units amid difficult conditions in some countries in Western Europe – mainly as a result of the changeover to the WLTP – and in the Chinese market, which was impacted by macroeconomic uncertainty. This was an increase of 62,541 vehicles or 0.6% on the previous year. The Group’s new SUV models made a particular contribution to this rise. As the passenger car market as a whole declined by 1.2% in the same period, the Volkswagen Group’s share of the global market rose to 12.3 (12.0)%. The largest increases in volume in absolute terms were seen in Brazil and Russia. Sales figures were down on the previous year in Germany, the United Kingdom, Mexico and Turkey, among other countries. The Volkswagen Passenger Cars, ŠKODA, SEAT, Porsche and Lamborghini brands delivered record numbers of vehicles. The brands that experienced the largest growth in absolute terms were ŠKODA and SEAT; Audi and Bentley fell short of the respective prior-year levels.

The table below gives an overview of passenger car deliveries to customers of the Volkswagen Group in the regions and the key individual markets. The demand trends for Group models in these markets and regions are described in the following sections.

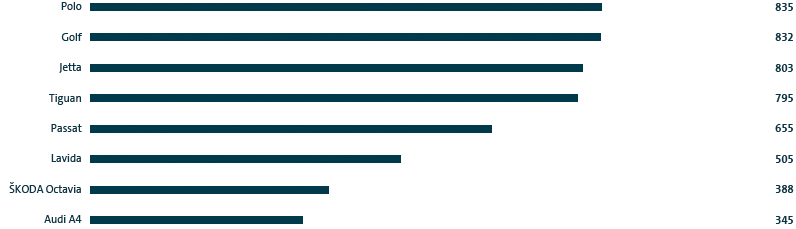

WORLDWIDE DELIVERIES OF THE GROUP’S MOST SUCCESSFUL MODEL RANGES IN 2018

Vehicles in thousands

Deliveries in Europe/Other markets

In the reporting period, the passenger car market as a whole in Western Europe fell 0.7% short of the prior-year figure. With 3,138,419 vehicles delivered to customers, the Volkswagen Group reached the level seen in the previous year (−0.6%) despite a considerable drop in the second half of the year resulting from the changeover to the WLTP. Other adverse effects were attributable to the fact that customer confidence has not yet been fully restored following the diesel issue and to customer uncertainty generated by the public discussion on driving bans for diesel vehicles. The ŠKODA Kodiaq, Porsche 911 and Porsche Cayenne saw encouraging growth. Furthermore, the new Polo, T-Roc, Tiguan Allspace and Arteon models from the Volkswagen Passenger Cars brand, the ŠKODA Karoq and SEAT Arona were very popular. The Touareg from Volkswagen Passenger Cars was successfully launched in the market along with the Audi A1 Sportback, Audi Q3, Audi A6, Audi A7 Sportback, Audi Q8 and ŠKODA Fabia. The Group’s share of the passenger car market in Western Europe was 22.0 (22.0)%.

In the significantly growing passenger car markets in the Central and Eastern Europe region, the number of deliveries to Volkswagen Group customers in fiscal year 2018 rose by 6.8% year-on-year. Whereas in Russia and Poland demand for Group models grew strongly in some cases, the number of vehicles sold in the Czech Republic saw a decline. The Polo and the Tiguan from Volkswagen Passenger Cars along with the ŠKODA Rapid and Octavia were the models most in demand. The new T-Roc from Volkswagen Passenger Cars, the ŠKODA Karoq and the SEAT Arona were also very popular SUV models. The Volkswagen Group’s share of the passenger car market in Central and Eastern Europe was 21.2 (22.0)%.

In Turkey, the Volkswagen Group delivered 40.5% fewer vehicles than in the previous year in a substantially weaker overall market. In South Africa’s passenger car market, which was almost on a level with the previous year, demand for Volkswagen Group vehicles rose by 3.5%. The best-selling Group model in South Africa was the Polo.

Deliveries in Germany

In the reporting period, the German passenger car market matched the high prior-year level (−0.2%). The Volkswagen Group delivered 1,121,289 vehicles to customers in its home market, a slight decrease on the prior-year level (−0.9%). In addition to the decreases in the second half of the year caused by the changeover to the WLTP, the fact that customer confidence has not yet been fully restored following the diesel issue weighed on demand, as did customer uncertainty generated by the public discussion on driving bans for diesel vehicles. The Golf continued to top the list of the most popular passenger cars in Germany in terms of registrations. The Polo, Tiguan and Passat Estate from Volkswagen Passenger Cars were among the most popular Group models, as were the ŠKODA Kodiaq, ŠKODA Octavia Combi and Audi A4 Avant. The new Polo, T-Roc, Tiguan Allspace and Arteon models from the Volkswagen Passenger Cars brand, the ŠKODA Karoq and the SEAT Arona were also in high demand among customers. In the registration statistics of the Kraftfahrt-Bundesamt (KBA – German Federal Motor Transport Authority), seven Group models led their respective segments at the end of 2018: the up!, Polo, Golf, Tiguan, Touran, Passat, and Porsche 911.

Deliveries in North America

Demand for Volkswagen Group models in North America in the reporting period was 2.0% lower than the prior-year figure at 943,621 vehicles in a slightly declining overall passenger car and light commercial vehicle market. The Group’s market share was 4.6 (4.7)%. The new Jetta was successfully rolled out. Moreover, the Tiguan Allspace was the most sought-after Group model in North America.

In the US market, demand for Volkswagen Group models rose by 2.1% in fiscal year 2018 compared with the previous year. In this period, the market as a whole matched the prior-year level. Demand remained higher for models in the SUV and pickup segments than for conventional passenger cars. The Group models achieving the largest increases in absolute terms were the Audi Q5 and Audi A5 Sportback. In addition, the Jetta and the Porsche Macan as well as the new Tiguan Allspace and Atlas SUVs from the Volkswagen Passenger Cars brand were very popular among customers.

In Canada, demand for Group models in the reporting period increased by 3.7% year-on-year in a shrinking overall market. The Golf saloon, Jetta and Audi Q5 models and the new Tiguan Allspace and Atlas SUVs from the Volkswagen Passenger Cars brand were particularly popular.

In the Mexican market, which was declining on the whole, the Volkswagen Group delivered 16.4% fewer vehicles to customers compared with the previous year. The Vento, Jetta and Tiguan Allspace models recorded the highest demand.

Deliveries in South America

The South American market for passenger cars and light commercial vehicles continued its recovery path overall in the reporting year. In this region we delivered 497,820 vehicles to customers, 11.7% more than a year before. Among others, the Virtus, Jetta and Touareg from the Volkswagen Passenger Cars brand were successfully launched in the market along with the Audi Q3, Audi Q8 and Porsche Boxster. The Volkswagen Group’s share of the passenger car market in South America rose to 11.9 (11.4)%.

The Brazilian market also recovered further in the reporting period. The Volkswagen Group benefited from this development and delivered 27.1% more vehicles to customers there than in the previous year. Above all, demand was particularly high for the new Polo and Virtus models from the Volkswagen Passenger Cars brand. Demand for the Gol and Amarok models also developed encouragingly.

In Argentina, the Group recorded a 22.3% decline in sales year-on-year amid a considerably weaker overall market. The Gol and Amarok recorded the highest demand among Group models. The new Polo, Virtus and Tiguan Allspace models were also well received by customers.

Deliveries in the Asia-Pacific region

In 2018, the passenger car markets in the Asia-Pacific region registered their first decline in many years. Despite adverse effects from the Chinese market in particular, the Volkswagen Group handed over 4,503,791 units to customers here, 0.9% more vehicles than a year before. The Volkswagen Group’s market share in the Asia-Pacific region rose to 12.5 (12.1)%.

China, the world’s largest single market and the main growth driver of the Asia-Pacific region for many years, experienced a downturn in the reporting period. The Volkswagen Group increased sales here and delivered 0.5% more vehicles to customers in China than in the prior year. The models that achieved the largest growth in absolute terms were the Magotan from Volkswagen Passenger Cars, the Audi A4 and the Porsche Panamera. In addition, the new Phideon from Volkswagen Passenger Cars and the ŠKODA Octavia Combi were highly sought-after. The new Teramont and Tiguan Allspace SUVs from the Volkswagen Passenger Cars brand, the Audi Q5 and the ŠKODA Kodiaq were also very popular. The T-Roc, Tayron, Tharu, Bora, Lavida, Gran Lavida, Passat and Touareg models from Volkswagen Passenger Cars as well as the Audi Q2 and ŠKODA’s Karoq and Kamiq models were successfully launched in the market.

The Indian passenger car market continued its growth in the reporting period. Demand for models from the Volkswagen Group fell by 15.4% in this period compared with the previous year. The Polo was the Group’s most sought-after model in India.

In Japan, the number of passenger cars delivered to Volkswagen Group customers exceeded the prior-year figure by 1.8%, while the total market volume remained on the prior-year level. The Polo and Audi Q2 models recorded promising increases in demand.

| (XLS:)

|

PASSENGER CAR DELIVERIES TO CUSTOMERS BY MARKET1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2018 |

2017 |

(%) |

|||||

|

||||||||

|

|

|

|

|||||

Europe/Other markets |

4,156,065 |

4,167,753 |

−0.3 |

|||||

Western Europe |

3,138,419 |

3,157,107 |

−0.6 |

|||||

of which: Germany |

1,121,289 |

1,131,417 |

−0.9 |

|||||

United Kingdom |

493,768 |

531,592 |

−7.1 |

|||||

Spain |

291,407 |

270,640 |

+7.7 |

|||||

Italy |

273,548 |

259,920 |

+5.2 |

|||||

France |

259,468 |

256,716 |

+1.1 |

|||||

Central and Eastern Europe |

713,799 |

668,629 |

+6.8 |

|||||

of which: Russia |

209,261 |

173,491 |

+20.6 |

|||||

Poland |

152,720 |

145,024 |

+5.3 |

|||||

Czech Republic |

131,761 |

142,842 |

−7.8 |

|||||

Other markets |

303,847 |

342,017 |

−11.2 |

|||||

of which: Turkey |

94,335 |

158,523 |

−40.5 |

|||||

South Africa |

82,744 |

79,968 |

+3.5 |

|||||

North America |

943,621 |

962,980 |

−2.0 |

|||||

of which: USA |

638,274 |

625,128 |

+2.1 |

|||||

Mexico |

186,864 |

223,548 |

−16.4 |

|||||

Canada |

118,483 |

114,304 |

+3.7 |

|||||

South America |

497,820 |

445,636 |

+11.7 |

|||||

of which: Brazil |

346,025 |

272,231 |

+27.1 |

|||||

Argentina |

97,224 |

125,153 |

−22.3 |

|||||

Asia-Pacific |

4,503,791 |

4,462,387 |

+0.9 |

|||||

of which: China |

4,196,702 |

4,173,834 |

+0.5 |

|||||

Japan |

86,356 |

84,827 |

+1.8 |

|||||

India |

61,277 |

72,467 |

−15.4 |

|||||

Worldwide |

10,101,297 |

10,038,756 |

+0.6 |

|||||

Volkswagen Passenger Cars |

6,244,869 |

6,230,335 |

+0.2 |

|||||

Audi |

1,812,485 |

1,878,105 |

−3.5 |

|||||

ŠKODA |

1,253,741 |

1,200,535 |

+4.4 |

|||||

SEAT |

517,627 |

468,431 |

+10.5 |

|||||

Bentley |

10,494 |

11,089 |

−5.4 |

|||||

Lamborghini |

5,750 |

3,815 |

+50.7 |

|||||

Porsche |

256,255 |

246,375 |

+4.0 |

|||||

Bugatti |

76 |

71 |

+7.0 |

|||||

COMMERCIAL VEHICLE DELIVERIES

The Volkswagen Group delivered a total of 732,715 commercial vehicles to customers worldwide in 2018 (+4.3%). Trucks accounted for 202,492 (+10.4%) units and buses for 22,629 (+17.8%) units. Sales of light commercial vehicles increased by 1.5% year-on-year to 507,594 units.

In Western Europe, deliveries were up by 4.3% on the previous year at 445,081 vehicles; of this total, 344,034 were light commercial vehicles, 95,299 were trucks and 5,748 were buses. The Transporter and Caddy were the most sought-after Group models in the Western European markets.

We handed over 83,365 vehicles to customers in the markets in Central and Eastern Europe in the period from January to December 2018 (+9.6%); of this figure, 44,530 were light commercial vehicles, 37,400 were trucks and 1,435 were buses. The Transporter and the Caddy were the Group models experiencing the highest demand. In Russia, the region’s largest market, sales climbed in the wake of economic recovery by 12.4% year-on-year to 20,567 units.

In the Other markets, particularly in Turkey, deliveries of Volkswagen Group commercial vehicles fell by 15.8% to a total of 56,514 units: 38,271 light commercial vehicles, 14,491 trucks and 3,752 buses.

Deliveries in North America amounted to 13,074 vehicles (−2.5%), which were handed over almost exclusively to customers in Mexico. In this region, we handed over 9,567 light commercial vehicles, 1,256 trucks and 2,251 buses to customers.

The Volkswagen Group sold a total of 92,161 units (+21.3%) in South America. Of the units delivered, 44,417 were light commercial vehicles, 40,451 were trucks and 7,293 were buses. The Amarok was particularly popular. Following continued improvement in the economic climate, deliveries rose by 55.7% in Brazil; 17,739 light commercial vehicles, 32,903 trucks and 5,081 buses were handed over to customers here.

In the Asia-Pacific region, the Volkswagen Group sold 42,520 vehicles in the reporting period: 26,775 light commercial vehicles, 13,595 trucks and 2,150 buses. In total this was 2.2% less than in the previous year. The Transporter and the Amarok were the most popular Group models. In China, sales were on a level with the previous year at 10,353 vehicles (−0.5%). Of this total, 5,695 were light commercial vehicles, 4,247 were trucks and 411 were buses.

| (XLS:)

|

COMMERCIAL VEHICLE DELIVERIES TO CUSTOMERS BY MARKET1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2018 |

2017 |

(%) |

|||||

|

||||||||

|

|

|

|

|||||

Europe/Other markets |

584,960 |

569,962 |

+2.6 |

|||||

Western Europe |

445,081 |

426,773 |

+4.3 |

|||||

Central and Eastern Europe |

83,365 |

76,031 |

+9.6 |

|||||

Other markets |

56,514 |

67,158 |

−15.8 |

|||||

North America |

13,074 |

13,410 |

−2.5 |

|||||

South America |

92,161 |

75,949 |

+21.3 |

|||||

of which: Brazil |

55,723 |

35,781 |

+55.7 |

|||||

Asia-Pacific |

42,520 |

43,457 |

−2.2 |

|||||

of which: China |

10,353 |

10,408 |

−0.5 |

|||||

Worldwide |

732,715 |

702,778 |

+4.3 |

|||||

Volkswagen Commercial Vehicles |

499,723 |

497,862 |

+0.4 |

|||||

Scania |

96,475 |

90,782 |

+6.3 |

|||||

MAN |

136,517 |

114,134 |

+19.6 |

|||||

DELIVERIES IN THE POWER ENGINEERING SEGMENT

Orders in the Power Engineering segment are usually part of major investment projects. Lead times typically range from just under one year to several years, and partial deliveries as construction progresses are common. Accordingly, there is a time lag between incoming orders and sales revenue from the new construction business.

Sales revenue in the Power Engineering segment was largely driven by Engines & Marine Systems and Turbomachinery, which together generated two-thirds of overall sales revenue.